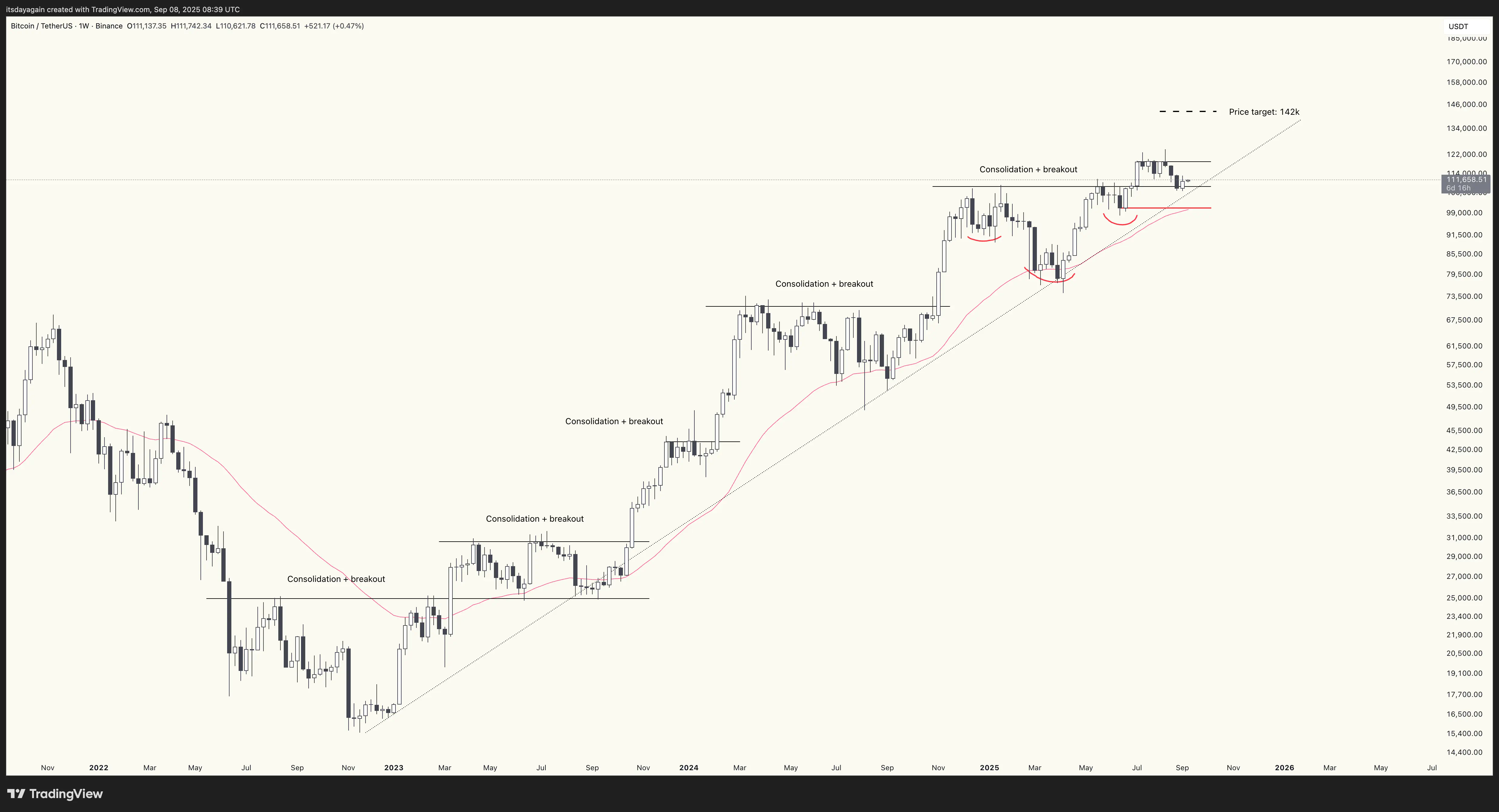

Bitcoin weekly: $109k resistance turned support

Bitcoin closed the week at $111k on a small bounce from support at $109k. The breakout from early July is still in play, with the price target of $142k intact. Bitcoin dominance keeps trending down, meaning altseason is still on.

Also watch the accompanying chart analysis on YouTube.

In macro land, this week everybody was focused on the US job numbers, trying to judge the prospects of the Fed starting their much anticipated rate cuts on September 17. For the Fed to cut, the job numbers need to be on the weak side. Though if they’re too weak, the market will start to fear a full blown recession. So they need to come in a little bit weak, but not too weak. And that’s how they came in: weak, but not catastrophic. The market now sees a 100% probability of a rate cut in two weeks.

So far, so good. There is more inflation data coming on Wednesday and Thursday, so we’ll see where that comes in. But for now, the US stock market seems happy enough, closing the week near all time highs.

Turning to the bitcoin chart, it closed the week on a small bounce from the support level at $109k that we talked about last week. No need to overanalyze this. Support is support. And because we’re still well above $100k, the price target of $142k remains intact.

Meanwhile, bitcoin dominance bounced a little, and I think it could keep bouncing in the week ahead. But zooming out, it’s still clearly trending down, meaning altseason is still on.

That’s it. No need to make things too complicated here. Looking at the charts there is no reason for concern yet. So let’s see what the coming week brings!