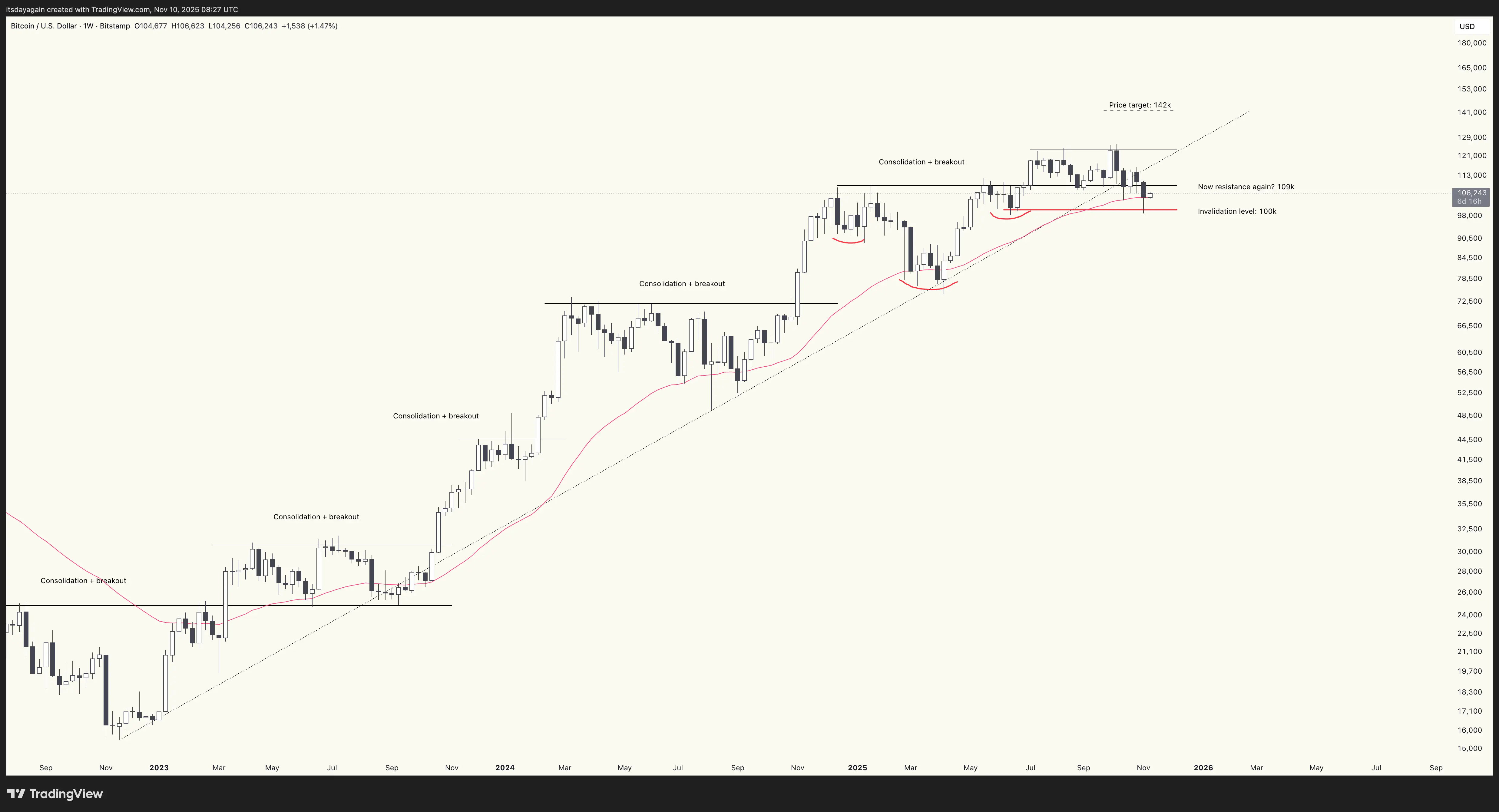

Bitcoin weekly: 50 week SMA holds

While AI jitters saw stock markets continue down last week, this correction could still turn into a minor speed bump in an ongoing rally. In crypto, bitcoin is showing weakness losing support at $109k. However, it still remains above the 50 week SMA, with a price target of $142k, making it too early to call any tops.

Also watch the accompanying chart analysis on YouTube.

In the wake of Powell’s hawkishness at the FOMC press conference the week before last, this past week tradfi markets continued down, seemingly worried that the crazy spending on AI is leading to a bubble.

It’s obvious that AI is indeed in a bubble, and it will all come crashing down at one point or another. But that doesn’t mean markets will crash tomorrow, or even in three months from now. Usually, tops don’t happen when everybody’s fearful, but on maximum greed. It’s still very possible that this recent fear is more a case of narrative following price than the other way around: people see stocks naturally correcting after a rally, they get all anxious, and start looking for a narrative to fit their emotions.

In the end, nobody knows when the top will be, but trying to call tops is generally a losing game. For all we know, markets could be back up at new all time highs in two weeks from now. Or not. But until there are clear signs of tops in the charts, we’ll just have to wait and see.

Looking to the crypto charts, there is no denying that they have been showing weakness. Bitcoin went all the way down to $99k during the week. In the end, it bounced back up and closed the week slightly below $105k. This weekly close broke the $109k support level that has held all the way since the breakout back in early July. Losing this level is not a show of strength.

On the other hand, the breakout invalidation level at $100k is still holding. And perhaps more importantly, the week closed above the 50 week SMA ($103.2k). This moving average has been a reliable indicator in the past: stay above it and bitcoin remains in a bull market, drop down below it and it’s good night.

So with this in mind, it’s still too early to call a top in bitcoin. Staying above $100k means the price target at $142k remains, and closing above the 50 week SMA adds confidence that the top is not yet in.

Bitcoin dominance ended the week flat, closing at 59.9% with a long wick to the upside. Prior support and the 40 week EMA are now acting as resistance. This would be a natural spot for dominance to turn down again, if the real downtrend has started. But until it does, altseason is on pause.

In summary, the charts call for patience.