Bitcoin Weekly: Trump Screwed Us (Again)

Trump wants to "acquire" Greenland, and is threatening Europe with more tariffs if they don’t play nice. Stock markets are not liking the uncertainty, and crypto is taking a blow. The bullish ascending triangle that broke out on bitcoin last week is now in question, and the pattern is eerily similar to what happened after the top in 2021.

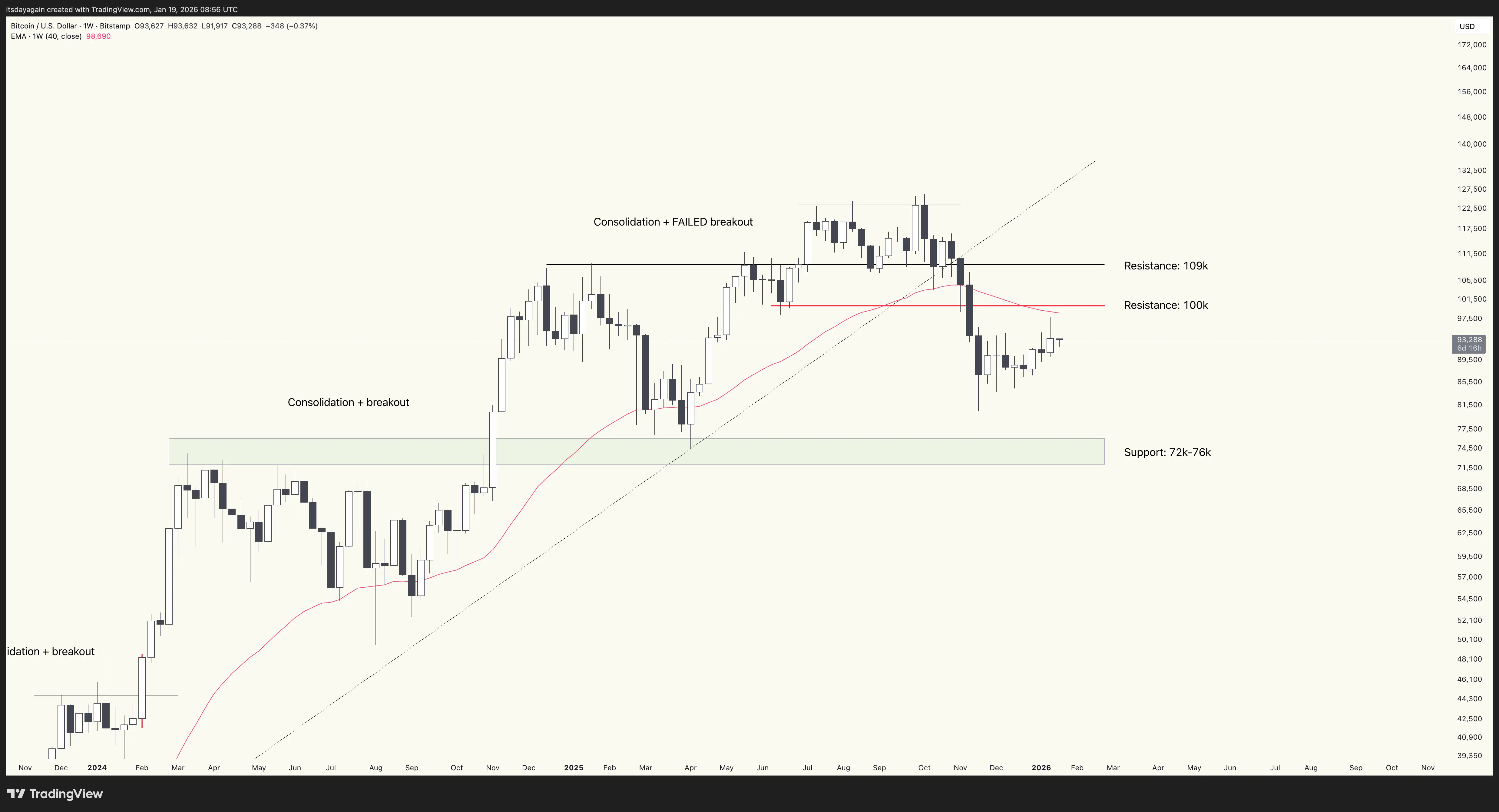

On the weekly bitcoin chart, the situation has not changed. It’s still bouncing after the breakdown back in November, but also still below heavy technical resistance at 100k and 109k. Long term support remains at 72-76k.

The daily chart is more interesting.

On Wednesday, the ascending triangle that I wrote about last week broke out, setting a price target of 105k. Right after the breakout, it looked like the relief rally was gaining steam. But then soon after, it met resistance, and is now trading back down below the breakout line.

This could be a deep retest of the breakout level, to be followed by a new breakout. But it’s also a real possibility that this turns into a failed breakout.

What concerns me is how eerily similar this situation is to what happened after the top in 2021.

Back then, after the breakdown, bitcoin found a local bottom in mid January 2022, and then rallied over the following two months, forming an ascending triangle. This triangle broke out in late March 2022, at the same time also breaking above the 40 week EMA, setting up a price target at 57.5k. But despite the strong breakout, it failed shortly thereafter, and bitcoin continued down into a deep bear market for the rest of 2022.

I don’t know if history will repeat. But I do remember that time period, and I remember how many people were fooled by that false breakout (including myself).

So with this in mind, my call since the November breakdown remains: stay cautious.