How To Screen A Crypto Project

How I quickly find the true crypto gems among the heaps of garbage.

Invest or Throw It In the Garbage Bin?

That’s the question, right? There are thousands of crypto projects out there. From the top players that everybody knows about, down to the niche altcoins only familiar to those of us deep down in the crypto weeds. But whether big or small, the question is the same: how do you know which ones are worth investing in?

The answer is this: you need a method, a way to systematically judge new projects you come across. This method needs to help you quickly decide if you should a) spend more time researching the project, or b) chuck it in the garbage bin and move on to the next opportunity.

This article describes my method for doing this. I call it my screening process. I first designed it three years ago, and since then I’ve used it to screen hundreds of projects. It works well for me, and I’m confident that it will work well for you too.

NOTE: Of course this process is not perfect. No process is. There will be projects that fail this screening that will end up doing well. And there will be projects that pass, that in the end won't make it. That's just the nature of the game. But the good news is that the process doesn't have to be perfect, it just has to be good enough to catch most of the good projects, most of the time.

The Scoring System

First let’s go over the scoring system I use. It’s very simple, with just three possible scores:

- GOOD: Candidate for long term investment.

- OKAY: Candidate for shorter term trading, but no more.

- FAIL: Garbage. Forget about it.

Good projects are the ones that show enough promise to become high conviction investments in the long term. This means I think they have an upside potential of at least 10x. That doesn’t mean a 10x is guaranteed, but that there is a decent chance for a 10x return or more.

Okay means that the project is just that: okay. It makes sense, and it’s not an obvious scam. But it’s also likely just not good enough to cut it against the competition. These projects are fine to trade, but not suited for longer term high conviction investment.

Fail on the other hand, that’s pure garbage. Whether that be straight up scams, coins that have been abandoned, or simply crappy products, these are not even worth trading, and you should just forget about them.

What I Look For In a Crypto Project

When screening, I especially look for projects that:

- Stand out as professional relative to their market cap.

- Have a public and competent team, with a proven track record.

- Have no competitors, or are clearly better than their competitors.

- Are in line with popular narratives.

- Have an active community.

- Seem to be good at marketing.

I hold a relatively high standard, but I try not to be too picky. If I score a project as good initially, I can always lower that to an okay later on, if I find something better.

My 6 Step Screening Process

Now let’s dive into the actual process.

It consists of these 6 steps, which I will explain in detail in the rest of this article:

- Get an overview of the project.

- Understand the product.

- Assess the token.

- Look into the team.

- Explore the community.

- Make a final verdict.

Take Notes

I always take notes, or else I will forget the details. I use a simple text file in Markdown format, one file for each screened project. You don’t have to take notes like I do, but you should take notes. Use whatever works for you — a text file, a Word document, or pen and paper if you’re old-school — it doesn’t matter how you do it, what matters is that you do it. Feel free to use my template if you want to.

A Screening Should Take 1-2 Hours

Because this is a screening and not a deep analysis, I try not to spend too much time on each project. Just enough to get a sense of if it’s worth keeping an eye on, and if it will be worth analyzing deeper sometime in the future.

For reference, it takes me about 1-2 hours to screen most projects. If they’re reasonably good that is. Sometimes with garbage projects it takes just 5 minutes before I fail them. Starting out, it will take longer than that for you, but once you’ve gotten up to speed, that’s about how long it should take.

For examples of actual screening notes to get a sense of how I write them, or if you want to compare your notes to mine, check out the screenings section where I publish all my screenings since late 2025.

Step 1: The Overview

In this first step, the goal is to get an initial overview of the project.

I start by picking a project. Obviously. I keep a list of projects that caught my eye for one reason or another, so usually I’ll just pick one that I feel like looking into from this list. For every new project that I screen, I end up adding two more to this list, so running out of candidates is never a problem.

When I’ve chosen a project, here’s what I do next:

- Go to the project’s CoinMarketCap page.

- Write down the market cap and the price history into my screening notes.

- Have a quick look at the chart.

- Write down all the networks that the token is on.

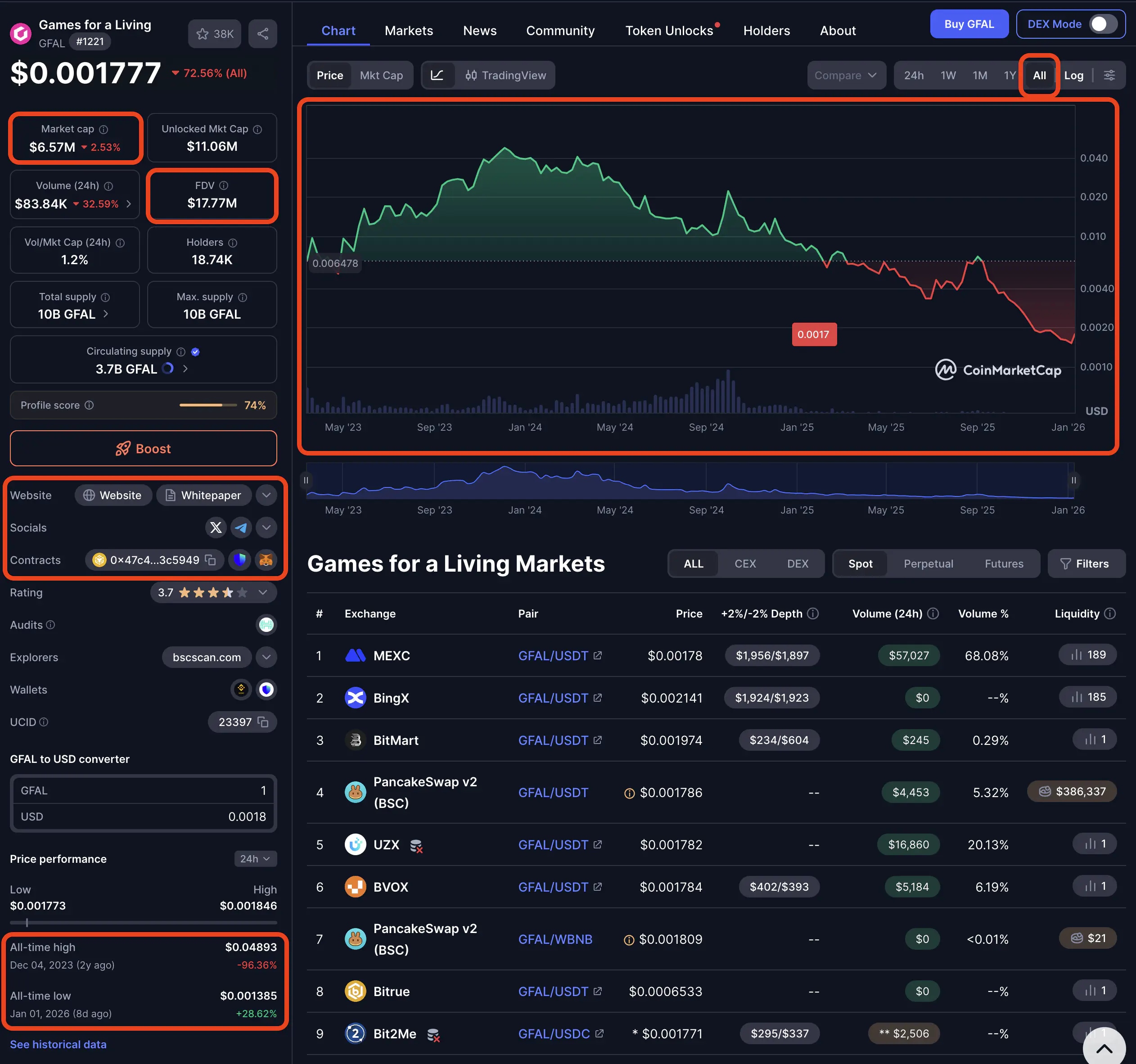

In the screenshot below you can see the parts of the CoinMarketCap page with the relevant information for this step. Everything else I ignore for now.

Already at this point, I sometimes fail projects. How? By looking at the price history. If the price history goes all the way back to before 2017, but then it didn’t reach a new all time high ever since, that’s a fail. Many coins only last one cycle, and I want to filter those out as early as possible.

That’s it for this step. I now move on to have a look at the product.

Step 2: The Product

With the basics established, next I try to figure out what the crypto project is about.

What Does the Product Do?

I start this step by going to their website, and try to answer these questions:

- What does the project do?

- Is the functionality presented in a clear way?

- Does the product make sense?

- It there a clear utility?

Ideally it should take less than 10 seconds to understand the big picture. If not, they probably aren’t communicating their message well. If it takes several minutes just to figure out what the hell they’re doing, how can I expect other investors to bother?

I have a background in computer programming, which makes it easier for me to understand the tech side of things. If you don’t, it can be hard to understand the technology involved, let alone judge if it’s any good. Just do the best you can. Common sense goes a long way here. Also don’t automatically think that you’re stupid if you don’t understand something. Maybe they aren’t communicating it well, or maybe their product just doesn’t make sense.

Many projects also have a separate technical documentation website with more details. Sometimes there is a link to this page on CoinMarketCap, sometimes not. There might also be a whitepaper. I always check those out. Usually it’s much easier to understand what the project is actually building from these, than it is from their main website.

Is There A Demand for the Product?

After reading the website and maybe the documentation too, and I feel that I have a decent grasp of what the project is doing, I move on to tackle these questions:

- Is there demand for the product?

- Do they have real, paying customers?

For any company to succeed, they obviously need to have paying customers. And crypto projects are no different: if nobody wants to use their product, they will fail. Sometimes it’s so early that the product hasn’t launched yet. If so, I try to judge if at least there’s a market demand for it.

As for paying customers, in crypto they can be for example:

- Users paying transaction fees to use the service.

- Customers buying access to the service. For example they might pay to store data, or to access some data.

- People buying the token to access some functionality that is only available to token holders.

- Advertisers buying ad space, for example in a game or on a social network.

Note that investors buying tokens do NOT count as paying customers.

What About Competitors?

With that covered, now there’s just one more question to answer for this step:

- Are there any well established competitors that you know of?

If there are, success will be hard. For example, starting an NFT marketplace, competing against OpenSea and MagicEden, that’s going to be a tough sell. When going up against an established competitor, your product has to be not just a little bit better, but 10 times better. Otherwise people are not going to bother switching from what they already know.

Wrapping Up Step 2

At this point I should have a basic grasp of what the project is about, and if their product has a shot at making it. I end up failing many projects at this point already. But if makes sense so far, I move on to the next step: looking into the token.

But before that, let me just mention that there is a LOT more to be said about how to analyze products and markets. I have only scratched the surface here, but it should be enough to get you started. Remember that you’re only screening here, not doing a deep analysis — the point is just to get a decent sense of the big picture.

Step 3: The Token

As an investor, obviously the token itself is extremely important. At the end of the day, the price of the token is what matters the most to me — a project can be fantastic and successful, and that’s all great, but if that doesn’t translate to token price go up, then I’m not going to make any money.

The two main questions I ask here are these:

- What does the token actually do?

- What is creating demand for the token?

In general, I look for signs that the token is well thought out. I want to get the sense that they thought about the token as a core part of the product right from the start. It should be deeply integrated into how the system works, with a clear reasoning for how it creates utility and demand.

The very best token models are those where revenue from the product somehow gets paid back to token holders. The simpler the mechanism, the better.

Good Tokens Have Clear Utility and Demand

Let me give you three examples of good tokens to make it more clear what I mean.

First, in GEODNET, profits from selling data generated by the network is used to buy GEOD tokens on the open market, and then permanently destroy them. This creates demand, and removes tokens from circulation, which over time should make the token price go up. This so called buyback and burn is done transparently on the Solana blockchain, so that everybody can see how many tokens are bought and destroyed. They have also set up a console on Dune with live statistics.

Second, Rollbit has a very similar model, where profits from their casino website are used to automatically buy back and burn tokens. This happens every hour, and there is a dashboard on their website where you can see every transaction.

Third, on Arweave, customers pay AR tokens to permanently store data on the Arweave network. Part of this storage fee is locked up in an endowment, effectively locking the tokens for decades. In fact, if the cost of storage keeps going down over time (likely), more and more tokens will be locked forever.

Bad Tokens Have Neither Utility nor Demand

So the examples above had simple and clear models, with a clear connection between usage of the product and demand for the token. Now let’s consider the opposite side.

Sometimes I get the feeling that the token was just slapped onto the product, with no real intention behind it other than making money by selling the token to investors. Many so called “governance” tokens fall into this category. These are tokens that have no clear utility, except some vague promise that token holders will get to direct the future of the project by some kind of voting.

Another type of token I’m very skeptical of is pure payment tokens. These are tokens that have no other utility than as a medium of exchange. In other words, they are only meant to be used to pay for goods and services. Except for Bitcoin, which has a strong narrative as a safe store of value, payment coins make no sense to me — why would people use a volatile crypto coin when they can just use stablecoins instead?

Tokens without real utility can do well in the short to medium term just off of pure hype, but without a mechanism to create real demand, they will struggle in the long run.

A special case of tokens with no utility is memecoins. These are a category of their own, with no other purpose than pure speculation. This actually isn’t necessarily a dealbreaker for me, as long as I’m aware of it. At least memecoins are up-front about being memecoins, unlike coins that portray themselves as having meaningful utility, when in fact they don’t.

Watch Out For Large Insider Allocations

There are many different ways of creating a token and releasing it onto the market, and the details matter.

Some projects have a completely fair launch where all tokens are released right from the start, for anybody to buy on the open market. But this is an exception rather than the norm. In most cases, there is some kind of pre-sale, or special allocation to early investors, along with some chunk of the supply being directly given to the team and to partners. And even in cases that supposedly are “fair”, often insiders scoop up large portions of the supply right after launch, before anybody else has the chance to get in.

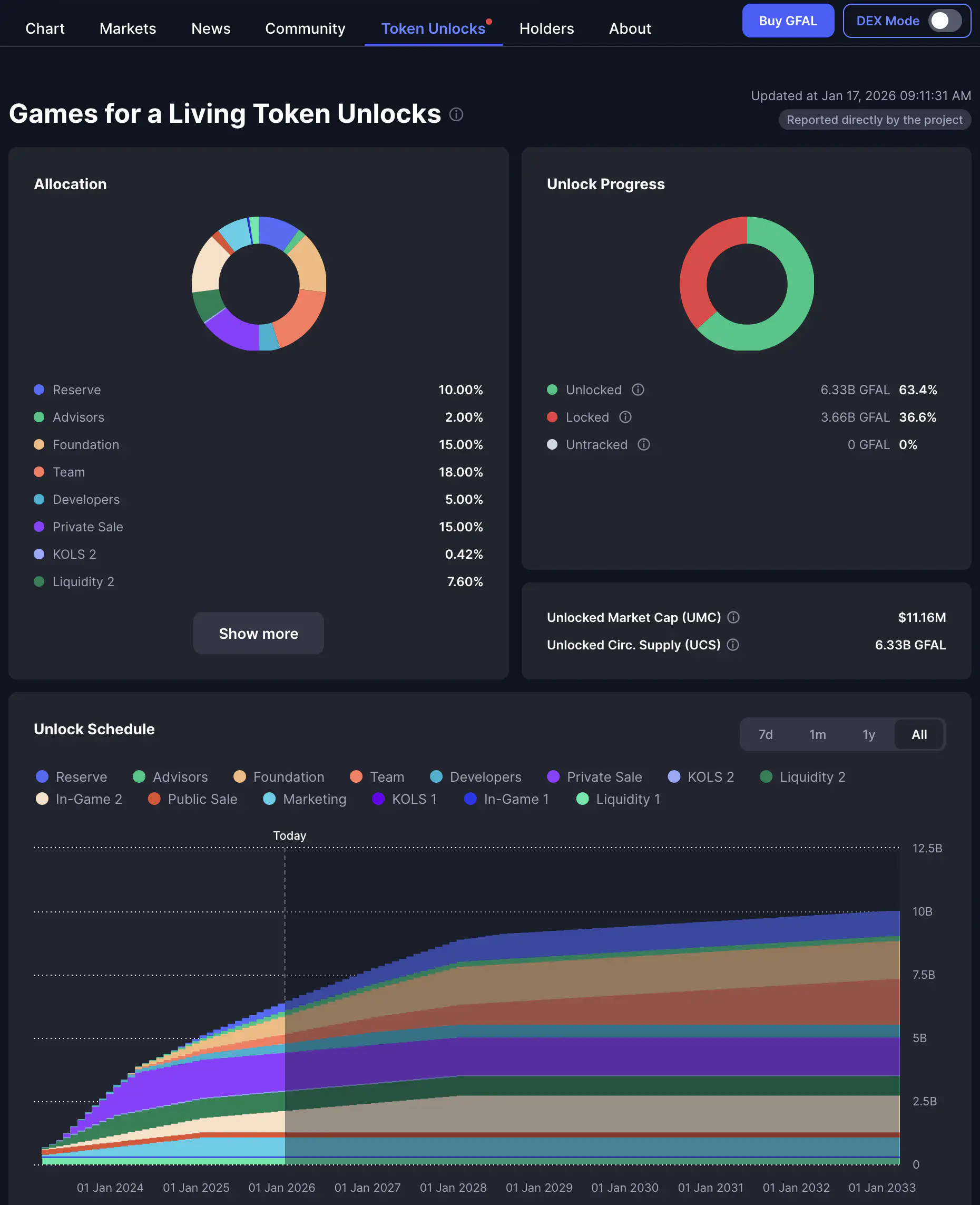

Usually the tokens allocated to investors, team, and so on are locked for a certain amount of time, before they can be sold. Often this unlock is gradual, with tokens being released on an ongoing basis over months and years.

The questions I ask here are these:

- How much of the supply was allocated to early investors? At what price?

- How much was allocated to the team? To partners? Etc.

- If tokens are locked, when are they being released?

All this information can often be found in a “tokenomics” section in the documentation or in the whitepaper, with charts showing allocations and unlocks. Sometimes the information is available directly on CoinMarketCap (see the screenshot below for an example.)

Token Inflation Is a Problem In Bear Markets

If there are many locked tokens that will be released over the next couple of years, that means the token has a high inflation. This will also be shown in the difference between the token’s market cap, versus its fully diluted valuation (FDV). The smaller the market cap is compared to the FDV, the higher the inflation will be. (I wrote these two numbers down in step 1.)

High token inflation is not necessarily a problem when the market is hot — in a bull market, demand can easily overpower inflation. The problem comes when the market turns around and demand weakens. With no new buyers coming in, and tokens being constantly released onto the market, there will be an unrelenting sell pressure slowly eating away at the price over months and years.

Wrapping Up Step 3

That concludes the token part. Here are the main takeaways:

- A simple mechanism with clear utility and demand = good.

- Watch out for large insider allocations.

- Inflation can be an issue, especially in bear markets.

Step 4: The Team

Having researched the product and the token, I then turn to the people behind it. They are just as important, if not even more important — ideas are good, but what really matters is execution, and execution all depends on the quality of the team.

Who Is on the Team and What Did They Do Before?

To get a sense of the people involved, I try to answer these questions:

- Is the team public?

- Do they seem competent?

- Do they have a relevant education for what they’re doing?

- Have they been successful with other things in the past?

- Are they good promoters of the project?

Sometimes it can be hard to find information about the team members, or even to find out who they actually are. People working in crypto might not want to be so public about it, and sometimes they even want to stay completely anonymous. In some cases, if the team is not mentioned on the website, there can be a section about them on the documentation site, or in the whitepaper. Searching on LinkedIn can work too. If the team is truly anonymous, I try to see if they are well known personalities in the crypto space. If they’re not, I get very suspicious.

The more public the team is, the better. I look for clear and up-front information about who is on the team, as well as their past accomplishments. The number one thing to look for here is evidence of success in the past. I want to see a proven track record that these people have built great things before. Education can be important, but it’s not at as important as a solid track record — if they did something great in the past, they’re likely to do it again.

When I have figured out who’s on the team, I search for them on YouTube to see if I can find any presentations or interviews. The more public and out there they are, the better. I find that one of the best ways to get a feel for a project is to listen to the founders. I’m looking for the ones that have a deep understanding of the problem space, and can communicate a clear and inspiring vision for the future — if I feel excited listening to them, I know that others will too.

Are There External Investors?

After I have a feel for the people involved, there’s just two more questions left for this step:

- Are they backed by venture capital investors?

- If so, who are the investors?

If there are investors backing the project, that means there are people who believe in the project enough to bet money on it. That’s good.

If they are well-known — Sequoia, a16z, Coinbase, Binance, etc. — then you know that the project is of high quality. So that can be a good sign. However, this is a mixed bag, because when these big players get involved it often drives up valuations too high. Be very careful if the big investors got in much cheaper than you’ll be able to, because no matter what they say, they will dump on you any chance they get.

Wrapping up Step 4

By now I have a good sense of the team. To summarize this step:

- Look for people who did great things in the past.

- The more public they are, the better.

- Especially look for leaders that inspire and communicate clearly.

- Watch out for big investors looking to dump on you.

If the team checks out, I now continue to the community.

Step 5: The Community

Communities play a much larger role in crypto than in web2, so the more active and well managed the commmunity is, the better

I look for signs that the project understands how to build and maintain their community. If they have a good community manager, that’s a sign that they do understand this. If they have a bad one, it shows that they don’t. A small project maybe doesn’t need a dedicated community manager, but there should at least be somebody on the team who takes on that role.

Here are the steps I take to assess the community:

Check Their X Account

Whatever your opinion is about X, it is still THE social media for crypto, bar none.

I start out by noting how many followers they have, and when the account was created. Then I spend a minute or two scrolling through their X feed — How often do they post? What are they posting about? How much engagement are they getting on their posts?

A project doesn’t have to have an active X account to be good. But if they have an active presence and a big reach on X, that’s a big plus. If their account was active in the past, but now has been dead for months, that’s a huge red flag, and I will probably fail the project.

Check Discord and Telegram

The two big platforms for crypto communities are Discord and Telegram, so those are what I check next. Some projects use both, but most center around one or the other.

I join their channels, and browse around to see how many people are in them, and how active they are. What I’m looking for is a) real people talking about real things, and b) the team being active in the chats. It’s usually easy to get a feel for this: are there real conversation with genuine excitement happening on a daily basis? Or just the occasional person asking for support?

Check YouTube and Blog

If there is a YouTube channel, I check it out next. Most crypto projects are not that active on YouTube, but if they are, that’s a plus. Sometimes there are regular updates or AMAs, and those are good signs that the community is well run.

If there is a blog, I check that out too. Having a blog is not necessary at all, but it can give some further hints. The quality of the articles will show how good they are at communicating. And if they’ve been writing regular weekly updates for a year or more, that’s a sign of good work ethic. On the other hand, if they had a blog in the past, but then they stopped writing, that’s a somewhat bad sign.

Wrapping Up Step 5

By this point, I usually have a fair idea of how big and how active the community is.

To recap:

- Look for signs of good community management.

- Check activity and engagement on X.

- See if chat channels have real conversations, with the team participating.

- YouTube and blog are not necessary, but nice to see.

Step 6: The Final Verdict

If at this point everything checks out — the product makes sense, the team seems competent enough, the tokenomics are solid, and the community is okay – then my verdict is either okay or good. I decide which one based on my overall impression of the project’s quality and potential.

And that’s it. I have now explained the whole process, and you now know enough to assess projects on your own.

It might seem much to take in at first, and when you start out screening your first few projects, it will indeed be challenging for you to judge them. This is natural, because you don’t have much to compare them to. But as you keep looking into more and more projects, you will get a better and better sense of what quality looks like, and it will get a lot easier.

Bonus Section: Where To Go Next?

After completing a screening, here’s what I do next:

- If the project was a fail, I forget about it.

- If it was good or okay, I add it to a watchlist in TradingView to keep track of it.

I also look up practical details like on what exchange I can buy it, and how good the liquidity is. Then I make a quick analysis of the chart, to see if right now is a good time to buy. Usually that’s not the case, and if so I just keep track of the chart every day until it is.

I use classical charting to analyze charts, but that’s outside the scope of this article. Follow my X account and my YouTube channel for more on that topic.

All the screenings that I’ve done since December 2025 are published on the screenings section on this website.